Kicking off with First-Time Home Buying Tips, this guide is here to help you ace your first home purchase like a pro. From setting your budget to negotiating with sellers, we’ve got you covered every step of the way.

Ready to dive into the world of real estate and secure your dream home? Let’s get started!

Factors to Consider Before Buying: First-Time Home Buying Tips

When embarking on the journey of buying your first home, there are several crucial factors to take into consideration to ensure a successful and fulfilling purchase.

The Importance of Setting a Budget

Setting a budget is the first step in the home buying process. It is essential to determine how much you can afford to spend on a home, taking into account not just the purchase price, but also additional costs like property taxes, insurance, and maintenance. By establishing a budget, you can narrow down your search and focus on properties that are within your financial means.

Researching Neighborhoods

Researching neighborhoods is key to finding the right location for your new home. Consider factors such as proximity to work, schools, amenities, and safety. Take the time to visit different neighborhoods, talk to residents, and explore the surroundings to get a feel for the area. This research will help you find a neighborhood that aligns with your lifestyle and preferences.

Getting Pre-Approved for a Mortgage

Before starting your home search, it is advisable to get pre-approved for a mortgage. This involves submitting financial documents to a lender who will assess your creditworthiness and determine how much they are willing to lend you. Being pre-approved not only gives you a clear idea of your budget but also shows sellers that you are a serious buyer, potentially giving you an edge in a competitive market.

Assessing Future Needs When Choosing a Home

When choosing a home, it is important to think about your future needs. Consider factors like family size, potential job changes, and lifestyle preferences. A home that meets your current needs may not necessarily accommodate your future plans. By thinking ahead and considering how your lifestyle may evolve, you can ensure that the home you choose will continue to meet your needs for years to come.

Understanding the Home Buying Process

Buying a home can be an exciting yet overwhelming process. Understanding the steps involved, different mortgage options, the role of a real estate agent, and the importance of home inspections is crucial for first-time homebuyers.

Steps in Purchasing a Home

- 1. Get pre-approved for a mortgage to determine your budget.

- 2. Find a real estate agent to help you search for properties.

- 3. Visit homes, make an offer, and negotiate the price with the seller.

- 4. Have a home inspection to identify any potential issues.

- 5. Close the deal by signing paperwork and finalizing the purchase.

Fixed-Rate vs. Adjustable-Rate Mortgages

When it comes to mortgages, you’ll encounter two main types: fixed-rate and adjustable-rate mortgages.

- Fixed-Rate Mortgages: Offer a stable interest rate throughout the loan term, providing predictability in monthly payments.

- Adjustable-Rate Mortgages: Have interest rates that can fluctuate based on market conditions, potentially leading to lower initial payments but higher risk.

Role of a Real Estate Agent

A real estate agent plays a crucial role in the home buying process by helping you navigate the market, negotiate offers, and handle paperwork.

Importance of Home Inspections

Home inspections are essential to identify any underlying issues with the property that may not be visible during a regular viewing. This step can potentially save you from costly repairs down the road.

Financial Preparation

Before diving into the home buying process, it’s crucial to ensure you are financially prepared. This involves improving your credit score, understanding down payments, closing costs, and creating a savings plan.

Improving Credit Score, First-Time Home Buying Tips

One of the first steps to take before buying a home is to work on improving your credit score. A higher credit score can help you secure a better interest rate on your mortgage, ultimately saving you money in the long run.

Understanding Down Payment

A down payment is a lump sum of money that you pay upfront towards the purchase of a home. The amount required for a down payment can vary, but it typically ranges from 3% to 20% of the home’s purchase price. The larger the down payment you can afford, the lower your monthly mortgage payments will be.

Closing Costs

Closing costs are fees associated with finalizing the home buying process. These costs can include loan origination fees, appraisal fees, title insurance, and more. It’s essential to factor in closing costs when budgeting for your home purchase, as they can add up to several thousand dollars.

Creating a Savings Plan

It’s important to create a savings plan specifically for homeownership. This plan should Artikel how much you need to save for a down payment, closing costs, moving expenses, and any other homeownership-related expenses. By setting aside a portion of your income each month, you can steadily work towards achieving your goal of buying a home.

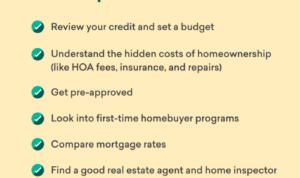

Tips for First-Time Home Buyers

Buying your first home can be overwhelming, but with the right tips, you can navigate the process smoothly and confidently.

Attending Open Houses and Home Showings

When attending open houses or home showings, make sure to take note of important details such as the condition of the house, neighborhood amenities, and any potential red flags. Ask questions and envision yourself living in the space to determine if it’s the right fit for you.

Having a Home Buying Checklist

Creating a home buying checklist can help you stay organized and focused during the house-hunting process. Include items such as your budget, must-have features, desired location, and any deal-breakers. Refer to your checklist when evaluating potential homes to ensure they meet your criteria.

Negotiating the Price with Sellers

Don’t be afraid to negotiate the price with sellers, especially if you believe the asking price is too high or if there are repairs that need to be addressed. Work with your real estate agent to come up with a reasonable offer and be prepared to walk away if the terms are not favorable.

Significance of a Home Warranty

For first-time buyers, a home warranty can provide peace of mind by covering the cost of repairs or replacements for major home systems and appliances. Consider including a home warranty in your purchase agreement to protect your investment and avoid unexpected expenses down the line.