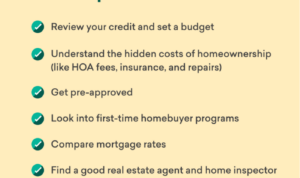

First-Time Home Buying Tips: If you’re a newbie in the real estate game, buckle up as we dive into the essential tips to make your first home purchase a breeze. From setting budgets to understanding mortgage options, we’ve got you covered.

Whether you’re eyeing that cozy suburban bungalow or a chic downtown loft, arming yourself with these tips will set you on the path to homeownership success.

Researching the Market

When diving into the real estate market as a first-time homebuyer, it’s crucial to conduct thorough research to make informed decisions.

Understanding Current Trends and Pricing

Before making any decisions, take the time to understand the current trends and pricing in the market. Look at recent sales data, average prices, and any forecasts that can give you an idea of where the market is heading.

Comparing Neighborhoods and Housing Options

Don’t settle for the first option you come across. Take the time to compare different neighborhoods and housing options. Consider factors like proximity to work, schools, amenities, and the overall vibe of the community.

Identifying Factors for Decision Making

- Location: The location of your future home can have a significant impact on your daily life. Consider factors like commute times, access to public transportation, and proximity to essential services.

- Amenities: Think about the amenities that are important to you. Whether it’s a backyard for your pets, a gym in the building, or a nearby park, make sure the property meets your needs.

- Resale Value: While you may be focused on your current needs, it’s essential to consider the resale value of the property. Look at past trends in the area and potential future developments that could affect the value of your home.

Setting a Budget

When it comes to buying your first home, setting a realistic budget is crucial to avoid financial strain and ensure a smooth home buying process.

Importance of Pre-Approval

Getting pre-approved for a mortgage is a key step in determining your budget range. This process involves a lender reviewing your financial information to give you an estimate of how much you can borrow. It helps you understand what you can afford and narrows down your home search to properties within your price range.

Consider Additional Expenses, First-Time Home Buying Tips

In addition to the down payment and monthly mortgage payments, it’s essential to consider other expenses when setting your budget. Property taxes, insurance, and maintenance costs should not be overlooked, as they can add up significantly over time. Make sure to factor in these additional expenses to avoid being caught off guard by unexpected financial burdens.

Understanding Mortgage Options

When it comes to buying your first home, understanding the different mortgage options available is crucial. Let’s break down the main types of mortgages and their pros and cons to help you make an informed decision.

Fixed-Rate Mortgages

Fixed-rate mortgages are popular among first-time homebuyers because they offer a stable interest rate throughout the loan term. This means your monthly payments will remain the same, providing predictability in budgeting. However, the initial interest rate may be higher compared to adjustable-rate mortgages.

Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) have interest rates that can fluctuate based on market conditions. While initial rates may be lower than fixed-rate mortgages, they can increase over time, leading to higher monthly payments. ARMs are suitable for buyers who plan to sell or refinance before the rate adjusts.

FHA Loans

FHA loans are backed by the Federal Housing Administration and are designed for buyers with lower credit scores or limited down payments. These loans offer competitive interest rates and require a minimum down payment of 3.5%. However, FHA loans come with additional mortgage insurance premiums, increasing the overall cost of the loan.

Comparing Mortgage Options

When comparing mortgage options, consider factors such as interest rates, loan terms, down payment requirements, and closing costs. It’s essential to shop around and get quotes from multiple lenders to find the best deal. Take into account your financial goals and long-term plans to choose the mortgage option that aligns with your needs.

Working with Real Estate Professionals: First-Time Home Buying Tips

When buying your first home, working with real estate professionals such as agents, brokers, and lawyers can make the process smoother and less stressful. These experts have the knowledge and experience to guide you through the complex real estate market, negotiate on your behalf, and ensure all legal aspects are covered.

Benefits of Working with Real Estate Professionals

- Access to market insights and expertise

- Help with paperwork and legal requirements

- Negotiation skills to get the best deal

- Guidance on finding the right property within your budget

Finding a Reliable Real Estate Professional

- Ask for recommendations from family and friends

- Research online reviews and ratings

- Interview multiple professionals before making a decision

- Ensure they are licensed and have a good track record

Communicating and Negotiating Effectively

- Be clear about your needs and expectations

- Ask questions and seek clarification when needed

- Stay in constant communication with your professional

- Trust their expertise but don’t hesitate to voice your concerns

Inspecting Properties

When buying a home, it is crucial to conduct a thorough property inspection to uncover any potential issues that may not be visible at first glance. This inspection can save you from costly repairs down the line and ensure you are making a wise investment.

What to Look For During a Property Inspection

- Structural Integrity: Check for any cracks in the walls, foundation, or ceilings that may indicate structural issues.

- Plumbing: Inspect the plumbing system for leaks, water pressure, and drainage issues.

- Electrical Systems: Ensure all outlets, switches, and electrical panels are in good working condition and up to code.

- Pest Infestations: Look for signs of pests such as termites, rodents, or insects that could cause damage to the property.

It’s recommended to hire a qualified home inspector who can provide a detailed report on the property’s condition.