Budgeting for Families sets the stage for smart money management, offering a roadmap to financial stability and success. Dive into the world of family budgeting and unleash the power of financial planning.

Learn the essentials of creating a budget, managing expenses, and teaching kids valuable money skills in this comprehensive guide tailored for families.

Importance of Budgeting for Families

Budgeting is crucial for families as it helps them manage their finances effectively, plan for the future, and achieve their financial goals. By creating a budget plan, families can track their income and expenses, prioritize their spending, and avoid unnecessary debt.

Benefits of Having a Budget Plan for Family Finances, Budgeting for Families

- Allows families to allocate funds for essentials such as housing, food, and utilities.

- Helps in saving for emergencies, education, retirement, and other long-term goals.

- Encourages open communication and collaboration among family members regarding financial decisions.

- Reduces stress and anxiety related to money management by providing a clear roadmap for financial stability.

Examples of How Budgeting Can Help Families Achieve Financial Goals

- Setting a specific monthly savings goal for a family vacation and adjusting spending habits to reach that target.

- Creating a budget plan to pay off existing debts systematically, leading to improved credit scores and financial health.

- Utilizing budgeting tools and apps to track expenses and identify areas where costs can be reduced or eliminated.

Creating a Family Budget: Budgeting For Families

Creating a family budget is essential for financial planning and ensuring that everyone in the household is on the same page when it comes to money matters. By following a few simple steps, you can set up a basic family budget plan that works for your unique needs.

Steps to Create a Basic Family Budget Plan

- List all sources of income: Start by documenting all sources of income for your family, including salaries, bonuses, rental income, or any other money coming in.

- Track expenses: Keep track of all expenses, big or small, for at least a month to get a clear picture of where your money is going.

- Create categories: Divide your expenses into categories such as groceries, utilities, housing, entertainment, and savings to better organize your spending.

- Set financial goals: Determine short-term and long-term financial goals for your family, whether it’s saving for a vacation, paying off debt, or building an emergency fund.

- Allocate funds: Based on your income and expenses, allocate specific amounts to each category to ensure you stay within your budget.

Tips on Involving All Family Members in the Budgeting Process

- Hold monthly family budget meetings: Gather everyone in the household to discuss budget updates, financial goals, and any adjustments that need to be made.

- Assign responsibilities: Delegate specific tasks to each family member, such as tracking expenses, researching cost-saving tips, or finding deals on groceries.

- Encourage open communication: Create a safe space for everyone to share their thoughts, concerns, and ideas about the family budget without judgment.

Tools and Software for Creating and Managing a Family Budget

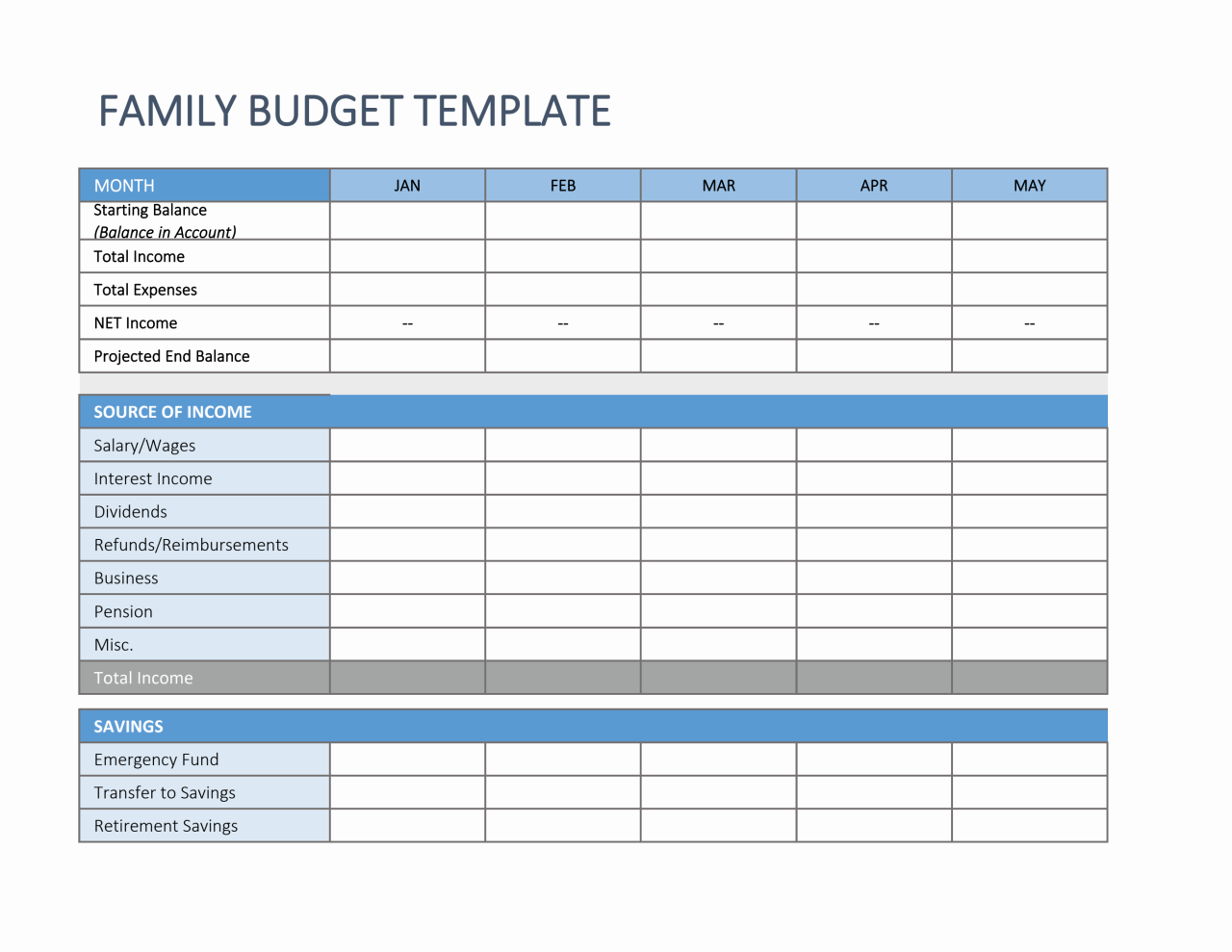

- Excel or Google Sheets: Use spreadsheet software to create a customized budget template that fits your family’s needs and allows for easy tracking of income and expenses.

- Budgeting apps: Explore various budgeting apps like Mint, YNAB (You Need A Budget), or EveryDollar to automate budgeting tasks, set financial goals, and receive real-time updates on your spending.

- Online banking tools: Many banks offer online budgeting tools that categorize your transactions, provide spending insights, and help you stay within your budget limits.

Managing Expenses Effectively

Budgeting for families is not just about setting limits on spending, but also about managing expenses effectively to ensure financial stability and meet long-term goals. By identifying common expenses, reducing unnecessary costs, and prioritizing spending based on family needs, households can achieve a healthy financial balance.

Identify Common Expenses

Before creating a budget, families should identify common expenses that are essential for daily living. These may include:

- Housing costs (rent or mortgage payments)

- Utilities (electricity, water, heating)

- Food and groceries

- Transportation (car payments, gas, public transportation)

- Healthcare expenses (insurance premiums, medical bills)

- Debt payments (credit cards, loans)

Reduce Unnecessary Expenses

To reduce unnecessary expenses and save money, families can consider the following strategies:

- Avoid impulse purchases and stick to a shopping list

- Cut down on dining out and cook meals at home

- Cancel unused subscriptions or memberships

- Comparison shop for better deals on regular expenses

- Limit entertainment expenses and find free or low-cost activities

Priority Spending Based on Family Needs

When prioritizing spending, families should focus on meeting essential needs first before allocating funds to other expenses. This can be done by:

- Setting aside a portion of income for savings and emergency funds

- Paying off high-interest debt to reduce financial burden

- Investing in education or career development for long-term growth

- Allocating funds for family goals such as vacations or home improvements

- Adjusting spending based on changing priorities and financial circumstances

Teaching Kids About Budgeting

Teaching children about budgeting is crucial for their financial literacy and future success. By instilling good financial habits at a young age, kids can develop a better understanding of the value of money and how to manage it wisely.

Importance of Teaching Children About Budgeting

Teaching children about budgeting helps them learn the importance of saving, setting financial goals, and making responsible spending decisions. It also instills discipline and self-control, which are essential skills for managing money effectively in the future.

- Introduce budgeting concepts through fun activities like setting up a pretend store at home or giving them a weekly allowance to manage.

- Use real-life examples to teach kids about budgeting, such as planning a family outing within a set budget or involving them in grocery shopping and comparing prices.

- Encourage kids to save a portion of their allowance or earnings towards a specific goal, such as buying a toy or saving for a bigger purchase.

Long-Term Benefits of Instilling Good Financial Habits in Children

Teaching kids about budgeting from a young age can have long-lasting benefits. It helps them develop a sense of responsibility, financial independence, and the ability to make informed decisions about money as they grow older.

By teaching children about budgeting, parents are equipping them with essential life skills that will set them up for financial success in the future.