Budgeting for Entrepreneurs sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

When it comes to navigating the financial landscape of entrepreneurship, mastering the art of budgeting is key. This guide delves into the importance of budgeting, creating a budget for your business, effective budget management strategies, and adapting budgets to changing business needs. Get ready to level up your money game!

Importance of Budgeting for Entrepreneurs

Budgeting is a crucial aspect for entrepreneurs as it helps in planning and managing financial resources effectively. Without a budget in place, entrepreneurs may face various challenges that can hinder the growth and success of their business.

Effective budgeting can positively impact a business in several ways:

Financial Planning

- Allows entrepreneurs to allocate resources wisely and plan for future expenses.

- Helps in identifying potential areas for cost-cutting and maximizing revenue streams.

- Enables entrepreneurs to set realistic financial goals and track progress towards achieving them.

Risk Mitigation

- Provides a safety net in case of unexpected expenses or economic downturns.

- Helps in identifying potential risks and developing strategies to mitigate them.

- Ensures that the business remains financially stable and can withstand market fluctuations.

Decision Making

- Allows entrepreneurs to make informed decisions based on financial data and projections.

- Helps in prioritizing investments and opportunities that align with the overall business goals.

- Ensures that resources are utilized efficiently and effectively to drive growth and profitability.

Not having a budget in place can pose significant risks for entrepreneurs:

Risks of Not Having a Budget

- Financial instability due to overspending or lack of funds for essential expenses.

- Inability to track and control expenses, leading to cash flow problems and potential bankruptcy.

- Lack of visibility into the financial health of the business, making it difficult to make strategic decisions.

Creating a Budget for Your Business

When starting a business, creating a budget is crucial for success. A well-planned budget helps entrepreneurs manage their finances effectively, track expenses, and set realistic financial goals. Here are the steps involved in creating a budget for a startup:

Identify Fixed and Variable Costs

- Fixed Costs: These are expenses that remain constant, such as rent, salaries, and insurance premiums.

- Variable Costs: These expenses fluctuate based on business activities, like raw materials, utilities, and marketing costs.

- Identifying these costs helps in determining the baseline expenses of the business.

Forecast Revenue

- Estimate the revenue your business is expected to generate based on market research and sales projections.

- Consider different revenue streams and be realistic in your forecasts to avoid overestimating income.

Allocate Funds for Contingencies

- Set aside a portion of your budget for unexpected expenses or emergencies to ensure financial stability during challenging times.

- Having a contingency fund can prevent cash flow issues and help the business stay afloat in unforeseen circumstances.

Track and Review Budget Regularly

- Monitor your actual expenses and revenue against the budget to identify any discrepancies or areas that need adjustment.

- Regularly reviewing the budget allows for modifications based on changing market conditions or business needs.

Strategies for Effective Budget Management

Effective budget management is crucial for the success of any business. It involves monitoring and controlling financial resources to ensure that the business operates within its means. Here are some strategies to help entrepreneurs manage their budgets effectively.

Techniques for Monitoring and Managing a Business Budget

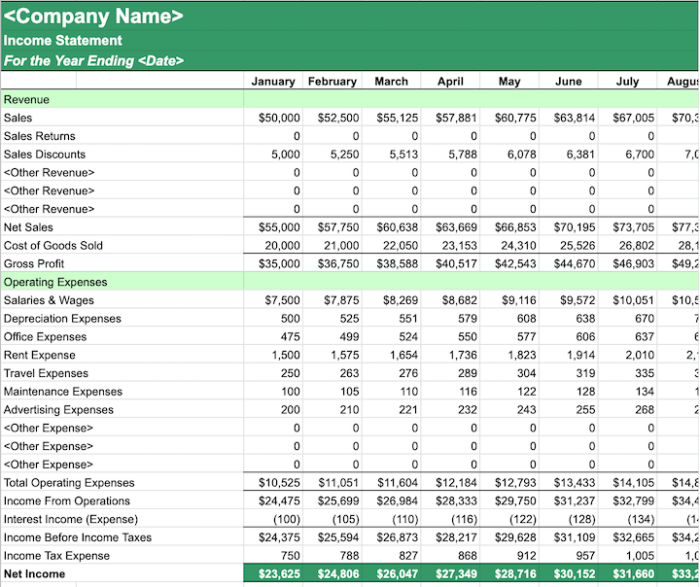

- Regularly review financial statements: Analyzing income statements, balance sheets, and cash flow statements can provide valuable insights into the financial health of the business.

- Set financial goals: Establishing clear financial goals can help guide budget decisions and prioritize spending.

- Track expenses: Keeping detailed records of all expenses can help identify areas where costs can be reduced or optimized.

- Implement budget checkpoints: Regularly compare actual financial performance with budgeted targets to identify any discrepancies and make necessary adjustments.

Comparison of Budgeting Methods Suitable for Entrepreneurs

- Zero-based budgeting: Involves starting from zero and justifying every expense, making it a comprehensive and detailed approach to budgeting.

- Incremental budgeting: Based on previous period budgets with incremental changes, making it simpler and quicker to prepare but may lead to overlooking inefficiencies.

Examples of Tools or Software for Budget Tracking

- QuickBooks: A popular accounting software that offers budgeting and forecasting features to help track income and expenses.

- Mint: A personal finance app that can be used to create budgets, track spending, and set financial goals.

- Zoho Books: An online accounting software that provides budgeting tools and financial reports to monitor business finances.

Adapting Budgets to Changing Business Needs: Budgeting For Entrepreneurs

Entrepreneurs often need to adjust their budgets to accommodate growth or unexpected changes in their business. This flexibility is crucial for the success and sustainability of a business. Here’s how entrepreneurs can effectively adapt their budgets when needed.

Identifying the Need for Budget Revision

When there is a significant change in the business environment, such as a sudden increase in demand, a shift in market trends, or unexpected expenses, it is necessary to revise the budget. Monitoring key performance indicators and financial metrics can help entrepreneurs identify when a budget adjustment is needed.

- Utilize financial reports to track revenue and expenses regularly.

- Stay informed about industry trends and economic factors that may impact the business.

- Engage with stakeholders and team members to gather insights on potential budget adjustments.

Effective Budget Adjustment Strategies, Budgeting for Entrepreneurs

Once the need for a budget revision is identified, entrepreneurs can take the following steps to adjust their budgets effectively:

- Reallocate funds: Shift resources from low-priority areas to support high-impact initiatives.

- Adjust revenue projections: Update sales forecasts based on current market conditions and customer demand.

- Review and renegotiate contracts: Explore opportunities to reduce costs through renegotiating vendor agreements or service contracts.

Examples of Successful Budget Adjustments

Several entrepreneurs have demonstrated the ability to adapt their budgets successfully to changing business needs. For instance, a small e-commerce startup increased its marketing budget after experiencing a surge in online sales during the holiday season. Another entrepreneur revised their production budget to invest in new technology that streamlined operations and reduced costs.

By being proactive and agile in adjusting budgets, entrepreneurs can ensure that their businesses remain resilient and responsive to evolving circumstances.