Real Estate Investing Tips: Get ready to dive into the world of property investment where passive income and long-term wealth await! From market analysis to financing strategies, this guide has you covered.

If you’re looking to secure your financial future through real estate, you’re in the right place. Let’s explore the ins and outs of smart investing in the real estate market.

Benefits of Real Estate Investing

Investing in real estate offers numerous advantages that set it apart from other investment options. Real estate can provide a steady stream of passive income through rental properties, allowing investors to build wealth over time. Additionally, real estate investments have the potential for long-term appreciation, leading to significant wealth accumulation in the future.

Passive Income Generation

- Real estate properties can generate passive income through rental payments from tenants.

- Income from real estate investments can provide financial stability and supplement other sources of income.

- Passive income allows investors to build wealth without actively working for it on a daily basis.

Long-Term Wealth Accumulation

- Real estate investments have the potential for long-term appreciation, increasing the value of the property over time.

- By holding onto properties for an extended period, investors can benefit from the growth of the real estate market.

- Long-term wealth accumulation through real estate can provide financial security for the future.

Tax Benefits, Real Estate Investing Tips

- Real estate investors can take advantage of tax benefits such as deductions on mortgage interest, property taxes, and depreciation.

- These tax benefits can help investors reduce their overall tax liability and increase their cash flow from real estate investments.

- Understanding and utilizing tax advantages in real estate can significantly impact the profitability of investments.

Types of Real Estate Investments: Real Estate Investing Tips

Investing in real estate offers a variety of options for individuals looking to grow their wealth. Understanding the different types of real estate investments can help investors choose the best strategy that aligns with their financial goals.

Residential Properties

Residential properties are homes intended for living purposes, such as single-family houses, apartments, and condominiums. Investing in residential properties can provide a steady rental income and potential appreciation in value over time. However, managing tenants and property maintenance can be time-consuming for landlords.

Commercial Properties

Commercial properties include office buildings, retail spaces, and industrial warehouses. Investing in commercial real estate can yield higher rental incomes compared to residential properties. However, vacancies in commercial properties can be longer, and finding suitable tenants may require more effort.

Industrial Properties

Industrial properties are used for manufacturing, storage, and distribution purposes. Investing in industrial real estate can offer stable long-term leases and higher rental yields. However, economic downturns or changes in market demand can impact the value of industrial properties.

Land Investments

Land investments involve purchasing undeveloped land for future development or resale. Investing in land can provide potential capital appreciation if the area undergoes development or zoning changes. However, land investments may require patience as the value can take time to appreciate.

Rental Properties vs. Real Estate Investment Trusts (REITs)

Investing in rental properties allows investors to have direct control over their assets and potentially earn higher rental incomes. On the other hand, Real Estate Investment Trusts (REITs) provide diversification and liquidity but may have lower returns compared to owning physical properties.

Fix-and-Flip Properties vs. Long-Term Rental Properties

Fix-and-flip properties involve purchasing distressed properties, renovating them, and selling them for a profit. This strategy can yield quick returns but comes with higher risks and requires expertise in property renovations. Long-term rental properties offer a steady stream of passive income but require ongoing property management and maintenance.

Real Estate Market Analysis

When it comes to real estate investing, conducting a thorough market analysis is crucial for identifying lucrative opportunities and making informed decisions. By analyzing various factors such as location, property appreciation potential, and market trends, investors can better understand the dynamics of a specific real estate market.

Factors to Consider in Market Research

- Evaluate the Location: Consider the proximity to amenities, schools, transportation, and other factors that can affect property value.

- Assess Property Appreciation Potential: Look into historical data and future development plans to gauge the potential for property value appreciation.

- Analyze Market Trends: Stay updated on market trends, such as average rent prices, vacancy rates, and new construction projects, to anticipate future demand and supply dynamics.

Importance of Demand and Supply Analysis

- Understanding Demand: Analyze population growth, job opportunities, and economic indicators to gauge the demand for real estate in a specific market.

- Evaluating Supply: Assess the current inventory of properties for sale or rent, as well as new construction projects, to determine the supply levels and potential competition in the market.

- Balance of Demand and Supply: By assessing the balance between demand and supply, investors can identify areas with high demand and limited supply, which can lead to higher property values and rental income.

Financing Strategies for Real Estate Investments

Real estate investing offers various financing options that can help investors achieve their goals. Understanding these strategies is crucial for success in the real estate market.

Traditional Mortgages

- Traditional mortgages are a common way to finance real estate investments.

- They typically require a down payment and are based on the borrower’s creditworthiness.

- Interest rates for traditional mortgages are usually lower compared to other financing options.

Hard Money Loans

- Hard money loans are short-term, high-interest loans based on the value of the property rather than the borrower’s credit.

- These loans are ideal for investors who need quick financing or have poor credit.

- Hard money loans often have higher interest rates and fees compared to traditional mortgages.

Seller Financing

- Seller financing involves the seller acting as the lender to the buyer.

- This option can be beneficial for buyers who may not qualify for traditional financing.

- Terms of seller financing can vary, offering flexibility for both parties involved.

Leveraging in Real Estate Investing

- Leveraging in real estate involves using borrowed capital to increase the potential return on investment.

- By leveraging, investors can control a larger asset with a smaller initial investment.

- However, leveraging also increases risk, as any losses will be amplified.

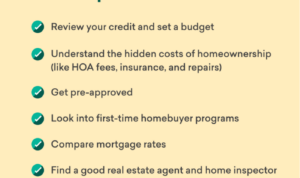

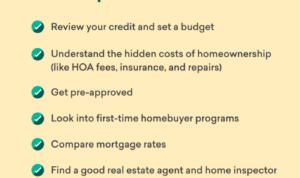

Improving Credit Scores for Better Loan Terms

- Improving credit scores is crucial to qualify for better loan terms and interest rates.

- Paying bills on time, reducing debt, and monitoring credit reports are key steps to improve credit.

- Higher credit scores can lead to lower interest rates, saving investors money over the life of the loan.

Property Management and Maintenance

When it comes to real estate investing, managing rental properties is a crucial aspect that can greatly impact your success in the market. Property management involves a range of responsibilities that need to be handled efficiently to ensure the profitability and sustainability of your investments.

Responsibilities of a Real Estate Investor in Managing Rental Properties

- Screening and selecting tenants to ensure reliable income streams.

- Collecting rent payments and enforcing lease agreements.

- Maintaining the property in good condition and addressing any repairs promptly.

- Dealing with tenant concerns and resolving disputes effectively.

- Keeping up with local rental regulations and compliance requirements.

Importance of Regular Property Maintenance

Regular property maintenance is essential to preserving the value of your investment property. It not only enhances the appeal of the property to potential tenants but also prevents costly repairs in the long run. By conducting regular inspections and addressing maintenance issues promptly, you can ensure that your property remains in top condition and retains its value over time.

Tips for Finding Reliable Property Management Companies or Self-Managing Rental Properties

- Research and compare different property management companies to find one that aligns with your investment goals and values.

- Ask for recommendations from other real estate investors or industry professionals to find reputable property management services.

- If you choose to self-manage your rental properties, establish clear processes and systems to streamline operations and ensure efficiency.

- Invest in property management software or tools to help you stay organized and manage your properties effectively.

- Regularly communicate with tenants to address any concerns or issues promptly and maintain positive relationships.